Building AI: from Strategy to impact

I was interviewed for the Influencers’ podcast, in May 2025, to speak on how to strategize and implement an impatful AI strategy that meets organisational objectives and delivers societal benefits

My host, Dr Giota Pimenidou and I, elaborated on how AI strategy can become a key differentiator in organisations’ quest for AI excellence: Strategy, in general, is perceived as something that takes time to put in place, has longer payback cycles, often leads to irreconcilable arguments between stakeholders, and lacks operational execution ability.

But in reality, the art and techniques for crafting strategies is changing. AI strategies in particular, are becoming more dynamic in nature, they’re tighten to immediate outcomes and timeboxed execution profiles, they’re easier to develop and communicate across the org – and are using AI itself to speed up

Having a solid AI strategy in place helps avoid dead ends in your AI journey, like mistaken extrapolations (overestimate/underestimate), generalizations (confusing performance with competence), and the importance of context (AI in the lab vs AI in the real world) – a solid strategy and planning is needed to help us navigate unforeseen situations – speed matters but your company’s reputation matters too, and any gains from a speedy and rushed product could easily evaporate if AI is not planned properly

AI factory to accelerate path to value with AI and GenAI

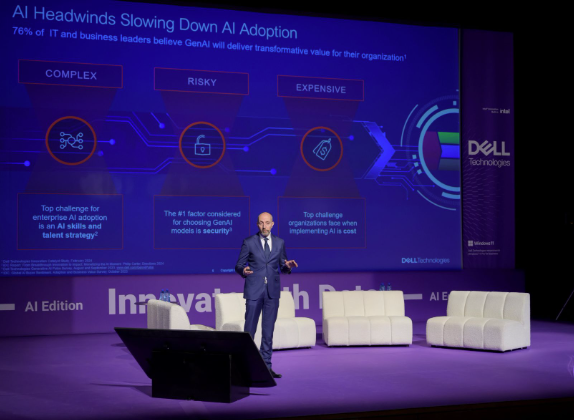

I was invited to speak at Innovate with Data event, in Athens, November 2024 on the transformative potential of industries using GenAI

I elaborated on the innovative, production-ready solutions and products from Dell, that help our customers accelerate their AI and GenAI journey. Dell has introduced a unique-in-industry concept, AI factory, that enables factory-like, fast, repeatable outcomes, for quality-checked AI solutions that help customers achieve ROI. Dell’s validated design incorporates data, infrastructure, an open ecosystem, qualified GenAI use cases and a world-class GenAI experts team from professional services to make it all real and help customers transition from the “litany of PoCs” state, to an enterprise-grade production-traffic AI ready, state.

Realize the value of Generative AI

I was invited to speak at the Word AI Festival in Cannes, February 2024 on how you realize value with generative AI (GenAI).

I had the opportunity to engage in lots of interesting customer conversations about GenAI and how it could transform industries. There is huge interest, and urgency, in the market to move beyond PoC/pilot and MVP to full production GenAI and AI at scale. It appears that most companies struggle to scale up their initial explorations in GenAI and AI. One way to tackle this issue, is to adopt a holistic, strategic, approach of bringing AI to your data, using a systematic and proven approach to faster time-to-value, focusing on business outcomes.

This wide-ranging approach to value creation from GenAI, brings together key enablers for success: data, tooling, LLMs, algorithms, platforms, workflows, pipelines, workloads placements, ops and monitoring. The overarching framework for managing all that, effectivaly and efficiently, is a operational concept we advocate at Dell, AI factory.

*Put AI at work and make the world a better place*

Going the next steps: Unleashing the value of data with AI and ML

I was invited to speak at the Digital Transformation Europe event in London, in October 2022 on the value of AI and ML.

With my fellow panellists we debated the value AI and ML projects provide to an organisation and what are the common practices that make that value quantifiable and impactful across the organisation. I posit that AI and ML project should have a clear business target and aligned to the organisation’s business strategy with clear, and strategic long term goals. AI/ML projects might be able to demonstrate value early on through well crafted prototypes and MVPs, but productionizing these systems and enabling large scale deployment takes time and experience. It’s an iterative process where you start small, prove value and incrementally get more and more scale and impact through well thought of deployment strategies.

We also touched on culture and education issues and made it clear that AI/ML projects don’t live in isolation so the right culture and upskilling across the organisation is a must. Especially true for large scale deployments with strategic impact on the business.

The promise of AI/ML systems is big, and the maturity these technologies enjoy nowadays is a solid foundation to build upon and scale to support any business accelerate and enrich their strategic objectives.

The secrets behind AI & ML projects that deliver ROI

I was invited to speak at the Digital Transformation X event in London, in July 2022 on ROI for AI/ML projects.

With my fellow panellists we debated the role of AI/ML projects in an enterprise setting and what are the common traits we observe for successful projects that deliver ROI. I posit that AI/ML has progressed a lot in recent years and is becoming a disciplined engineering science which helps insert structure in ROI decision making. We need to understand the dimensions of Return on Investment and the time horizon for this. For some, return could be quantified in monetary value but for others could be a qualitative measure or a process initiation and endorsement milestone. Data are crucial in modern AI/ML projects, and there is a need for structured and well orchestrated data pipelines – which ideally should be handled with the appropriate data governance through a CDO function. We highlighted the role of standards, like CRISP-ML, and also the role of Ops – MLOps/AIOps – and an operating model to make clear to the rest of the organisation how the AI/ML projects will be embedded in the business and delivery value – hence, ROI, consistently. The discussion also touched upon aspects of technology provision with the perennial debate on build vs. buy. I posit that a hybrid approach here works best – don’t try to reinvent the wheel but at the same time don’t surrender all the exciting work and long term projects to external vendors – it pays off to have an internal AI/ML capability – strategically and commercially.

Blockchain for Business

I was invited to keynote speak at the Blockchain in Business conference, in December 2021, organised by Boussias. Due to the ongoing pandemic at the time, the event was held online-only. The audience and theme of the conference was purely business focused, so that gave me the opportunity to talk about my favourite topic: how to use blockchain in a business context

I presented used cases from real world experiences I had in four key industries, financial services, energy, consumer electronics and packaged consumer goods. I elaborated on many practical applications of blockchain, ranging from supply chain track and trace, to NFTs, transactions’ reconciliation and smart contracts for peer-to-peer energy trading.

Overall, my talk was not about how to get things off the ground and get started with blockchain, but on what you should be looking for in terms of blockers and how to overcome them. I provided an overview of the frontiers emerging in this space and what planners should be looking for in order to strategically invest and use blockchain technology at scale. The presentation recording is available online here.

The majority of the content I used, is coming from my very own book on: Blockchain for Business: A Practical Guide to the Next Frontier, available from the publisher and popular bookstores.

Blockchain Frontiers

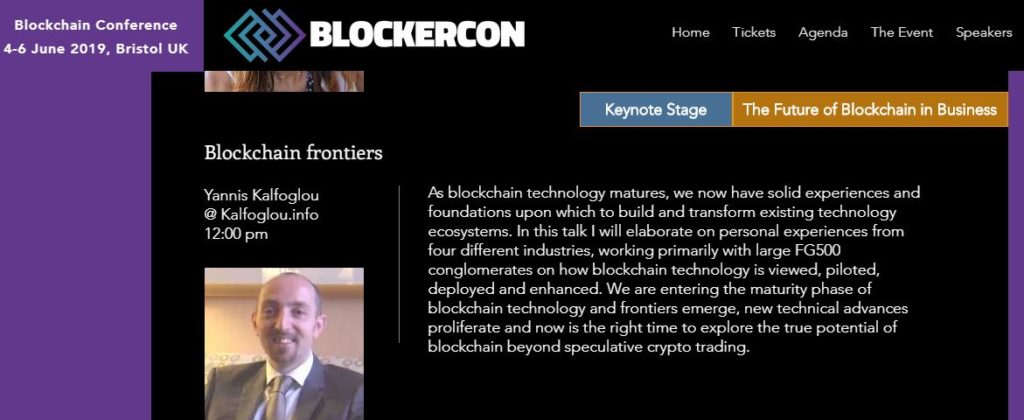

I was invited to talk about Blockchain Frontiers at Blockercon’19 event in Bristol, UK, June 2019. As the technology enters its second decade in life, new frontiers emerge toward a path to maturity and mainstream adoption.

Blockchain technology is entering its second decade in life. That is, if you regard as a starting point the genesis block of bitcoin back in January 2009. Of course, blockchain technology fundamentals are way older than that, but lets say for the sake of the new platform emerged that 2009 was the time that all the good work in cryptography, peer to peer networking, digital assets, all came together under one roof: blockchain.

We have seen a lot over the past ten years: from multibillion market caps, to thousands of new ventures, innovations, a plethora of industries all entering and using blockchain. In such a short time, the technology enjoys a global outreach and planetary scale impact. However, new frontiers emerge: increased debate over blockchain networks’ governance optimisation, consensus mechanisms’ efficiency and planetary scalability are strong cases where past experiences are guiding us to better alternatives. We should expect a few more multi-year cycles with blockchain technology before it becomes stable, omnipresent and planetary in impact and scale.

Also, equally imporarnt is the synergy with other tech: I posit that as the technology matures and stabilizes, it will find its role as an enabler, assistant and collaborator of other technology and systems; not a disruptor. We are reaching parity in large, existing businesses adopting and bringing blockchain solutions to the market versus startups bring solutions to the market. This is healthy, in my view, not necessary compromising the innovative spirit of blockchain pioneers. As it brings a level of maturity and relevance and counterbalances the radical application paths with pragmatic routes which are more grounded to proven commercial principles

We shall see more consumer-driven blockchain systems design and technology. Decentralization is key for blockchain innovation but we will see more on that in the next few years as dApps get more mature; so that focus on crypto trading takes second stage; and societal value driven blockchain systems become prime targets for entrepreneurs.

Our frontiers in today’s blockchain research will be tomorrow’s foundations as new frontiers will emerge. This means that we have to manage expectations accordingly. This is just an introduction to fascinating, thought provoking and future directions’ content that I’ve put together in a captivating book coming out around 2020/2021 -keep an eye on the publisher’s and Amazon’s page for availability!

AI and blockchain synergy

I was invited to a panel on synergies between AI and blockchain, at the Unlock 2019 event, in Dubai, UAE, January 2019

We had a great time debating the intriguing interplay between AI and blockchain in the context of smart cities. And what a perfect setting for this debate as Dubai is one of the leading, possible the leading smart city in the world. Fellow panelist and I converged our thoughts on the practicalities of combined both technologies to achieve greater efficiencies in smart cities.

In smart cities typically you’re trying to move from systems of record (legacy) to systems of insight (digital transformation). The key challenge is rooted to the origins of cities’ infrastructure which was focused on the record to report mantra, but rarely provisioned systems for generating insights for city planners. Obviously when these systems were put in place, the current Internet wasn’t what it is today. However, with the rapid urbanisation we are experiencing and projections that over 70% of the world’s population will be city dwellers by 2040, it makes sense to inject as much smartness as possible to our cities’ ageing infrastructure and systems.

That’s the AI bit: from machine-learning aided cameras to improve chain of custody applications (from vehicle number plate capture to service enactment) to natural language processing of citizens’ enquiries. At the same time, blockchain plays a big role too: smart contracts can automate lengthy and time consuming dispatch processes for field service agents, for example.

How about we were to combine them to achieve greater efficiencies? For example, smart cities’ dwellers could supply their own data to blockchain based systems, benefiting from the transparency and immutability underlying them; and then smart cities’ AI systems could use a federated and democratic data feeds’ pipeline so that we ensure personalized and optimized algorithms for every citizen.

There is a plethora of areas where AI can benefit blockchain systems and vice versa; I am actively working and advocating these for a couple of years now. The main ones are: make use of blockchain’s decentralized and federated nature of data origins to feed in AI systems, especially machine learning algorithms so that we avoid data biases and lock-in introduced by AI monopolistic systems. AI can benefit blockchain systems by optimizing the network consensus routing, injecting cognitive and semantic based processing to smart contracts.

Trends in AI and Blockchain

I was invited to a fireside chat on the latest trends on AI and Blockchain, at the Reload Greece Connect 2018 event, in London, October 2018

An enjoyable chat with moderator from Refinitiv, I elaborated on historical trends in AI and blockchain and how these mega-trends canents’ professional and advisor. I made a point of the seminal paper in 2012 which provided a breakthrough in performance of machine learning systems, the vicious cycle of more data, better algorithms, better UX/UI, resulting to even more data – the fuel of modern AI.

In terms investments in AI, my point is that there is no justification to not invest in the biggest commercial opportunity available today. Market research and analyst predict a multi-trillion dollar industry, so it can’t be ignored. The entry barrier is also becoming lower with a plethora of resources to get started, at least to a level that one understands the applications, limitations and in general technology landscape of AI today. I was asked about success stories, and we have a lot of them already in so many industries to list to list here but only looking at breakthrouhs in image processing and natural language processing is enough to get a feeling of the transformative power of AI.

However, there are limitations too: a lot of focus on a specific technique which is deep NN -but there are limitations there, such as lack of contextual awareness, a slight change in an image composition could cause maladaptation of the algorithm; data intelligence need to weed out the data you don’t need so as not to introduce bias and duplicates. The recent data deluge it is an Achilles heel for modern AI, you need them, but you need good quality data not just big and lots of data. You don’t get that much value anyway as you bit the limits of the law of diminishing returns – beyond a point, more data doesn’t improve performance.

We also talked about blockchain, of course. Again, from an historical perspective, I pointed out to the origins and early attempts to have some sort of a digital only currency – back in the 90s – a long time before the term blockchain and crypto-currencies were coined. Decentralization, disintermediation, and cryptographic level security are the core elements of blockchain and use cases derive from tokenization of our digital economy, tokens can represent everything that can be represented in a digital fashion.

Fintech 2020

I was invited to speak at the fintech 2020 panel, at the Fintech Week in New York, August 2018.

With my fellow co-panelistsfrom AvidXchange and Constellation Labs we debated trends and new technologies in fintech. I mentioned that AI can act as intelligent assistent for the investments’ professional and advisor. It is becoming a commodity these days with successful applications vary from robo-advisors to RPA (robotic process automation) tools. It is an intelligent aid, not a replacement, we will always have human-in-the-loop systems.

In terms of technological trends, I posited that GOFAI (good old fashio AI) and its contribution with semantic technology is coming together with modern deep learning techniques, so that take into account context in our automated machine leanring tools. We are going to need to tackle the issue of explainability as a key prerquisite for AI systems to be applied at large scale in a professional and regulated investments’ environment.

An interesting and thought provoking question from the moderator was on what do I perceive to be the most pervasive and mass market adoption solution for the financial services going forward. Interesting question indeed. I mentioned that the writing is on the wall for a number of years that the massive incumbents in the financial industry will have to face the harsh reality of modernaize or disappear as we are getting deeper and deeper in the digital economy. They will need to up their game and modernize and offer value to the community and clients, not only shareholders. In the long term future, I see that the landscape will evolve to one where the financial giants of today will tranform to a different kind of organisation where they will explore and enact new business models, ones that we do not know yet how they will look like. It is unlikely that these organisations will go, but they will change dramatically, from internal operations to product and service offerings. In the era of digital everything, a lot of core assumptions needs to be revisited. And AI, along with blockchain and other emerging technologies, will accelerate that change.

Blockchain 2018 and beyond

I was invited to speak at the blockchain trends beyond 2018 panel at the Blockchain Conference in Washington, July 2018

With my fellow co-panelist from Oracle and Cognizant, we debated what are the key trends in blockchain from an enterprise applications perspective. I posited that supply chain provides us with more intricate applications that the usual suspect of financial services. Supply chain industry, a multi-trillion industry, has so many different facets and opportunities to apply blockchain technology from a track and trace element, to sovereign identify of transacting parties, fraud detection and prevention, inventory control, just-in-time delivery and dispatch and many more.

A topic that found the panel participants partly disagree as supply chain applications for blockchain need agreement and consensus amongst competing parties, hence not an easy task. However the range of applications is wide and touches different aspects of the supply chain where prior-agreement is an necessity for a network formation.

We also debated the situation with the ICO market, clearly more challenging this year than a year ago. All panelist seemed to agree that we will probably move to some sort of a STO (security token offering) in the future, as the tokenization of our global digital economy is becoming a reality.

Costs and benefits of technology innovation

I was interviewed by the Fifth9 channel on the costs and benefits of technology innovation, at the Fintech Week in London, July 2018.

Some highlights of the interview here:

- AI will keep

trying to reach the level of natural intelligence, but it’s a moving target; - Entrepreneurship

is easy these days because of the massive ecosystem support and community,

resources and access to resources to start a business; - AI will not

replace jobs, rather, it’s an opportunity for a skills’ refresh, new jobs will

be created, but the skills’ gap needs to be addressed – access to so many

online and other courses and training out there makes that easy

Blockchain predictions

I was invited to appear at a panel on Blockchain predictions, at the Fintech Week in London, July 2018.

With my fellow co-panelists from R3, Ripple Labs, SVK Crypto, we had a lively debate on what’s coming up in the blockchain world. I offered a few areas where progress has been made and could improve the state of practice:

- Regulations come

clearer and workable; - we are moving to

an era of “beyond crypto” – we saw a lot of attention, and possibly

failure of many projects who raised an insane amout of money using

crypto-currencies; however, I see that there is a lot of interesting use cases

in applications of blockchain that do not involve a “coin”, or a

crypto-currency; - we are moving to

other applications of blockchain and DLT, supply chain, different non-financial

services consortia appear; different protocols than proof of work – we need

protocols with greater efficiency and scalability

There was an interesting and strongly debated topic on the nature of blockchain protocols. I posit that the current versions are characterised by fat protocols and thin applications on top, but that’s not necessarily the best way for wide scale adoption in the enterprise world. We need more interoperability between chains – more intelligence at the application layer with regards to Dapps. Ideally, we need a thin but sophisticated protocol layer with easy connectivity to enterprise infrastructure with a choice of home-grown, marketplace or bespoke apps on top.

Finally, as is normal in these sort of panels, what’s the single most outlier prediction that could be a game changer: intelligent blockchains

Robo, AI and Data

I was invited to appear at a panel on Robo, AI and Data, at the Fintech Week in London, July 2018.

With my fellow co-panelist from Societe Generale, we discussed our experiences on the use of AI technology, robo-advisors and big data in the financial services industry. One of the topics we explored, was the recent spike in the interest of young people studying, learning and practicing AI. The anticipated new cohort of PhDs in AI and ML can only be a good thing for incumbents and startups alike. As AI is becoming omnipresent in the entire food chain across the organisation, more resources and smart people would be needed.

I also opened up my experiences on interesting applications of AI in the financial services, with robo-advisors be at the top of my list. Their impact on consumers is big and opens up institutional grade investments to the masses at low cost. On the institutional side, I elaborated on the use of and emergence of alternative data. Typically these salient data, or sensory data were not a core part of investment algorithms. But their increased availability and our capacity to process big data with ML algorithms combing through to find interesting patterns and correlations, the use of alternative data is getting popular.

As with most recent AI experiences, the audience is understandably concerned about the job factor: is AI taking over or not? I made it clear, that in my experienc is all about a symbiotic relationship where the AI system lives alongside the professional investments experts and help them do their jobs better, faster and more efficient.

Big data is also in need of more diligent engineering; especially as any bias in feed data for our AI-driven systems, result in unexpected results. There needs to be a thorough data engineering, wraggling and preparation before the data we collect can be of lasting value for our AI algorithms. An interesting question from the moderator on the single largest risk when an AI system advices on an investment idea or product, got both panelist agree that we need explainable AI systems that provide a clear rationale of why a particular investment recommendation is made and what where the logical steps that led to that recommendation. This is also a regulatory requirement these days, so needs to be catered for when deploying an AI-driven investments’ recommendation service.

Finally, I elaborated on the interesting use cases for AI in the asset management space; and pointed that distributions (or marketing in other industries) can be dramatically transformed by ML techniques which provide predictions for propensity to buy, likelihood to churn, hence redeem their positions in a fund, identify better opportunities for cross selling and in general provide a more pro-active platform for interaction with an asset managers’ end clients. I also pointed out to the emergence of prescriptive analytics, powered up by deep neural networks and cognitive engines, that identify not only what might happen (predictive analytics), but if an event happens, what is the best course of action – this is something core in the early days of AI and planning; but the new AI techniques make it more efficient.

AI at work

I was a keynote speaker at the IT360 business conference, in Athens, May 2018; and offered a talk on applications of AI

Having spent over 25 years in Artificial Intelligence, I was invited to share my experiences with an eager audience of business people wanting to understand where the hype ends and reality kicks in. AI is no stranger to hype. We’ve been trying to build an artificial intelligence since the mid 50s and progress has been remarkable over the years. Hence, the excitment recently with the advances in computational power, availability of data for training and new and improved algorithms for machine learning. AI is finally becoming of age and finds its way in many industries and market verticals.

In my talk, I gave a brief historical reference to AI – surprisingly, a lot of young engineers and researchers in AI tend to ignore or simply don’t know much about the origins of AI.Their only touch with the field is through the popular deep neural networks machine learning frameworks. But there is a lot more to AI than that. I then gave a synopsis of three simple, but powerful examples of using AI in business settings: a market analysis tool using data analytics and statistical inference techniques, a RPA (robotic process automation) use case for back-office function in the financial services sector, and an image recognition application for a waste management service in heavy industries. I pointed out to dangers of hype in AI and the importance for business audiences to be able to understand the limitations but also opportunities of AI. Some are obvious – such as does the AI system solve a real problem vs. just been trendy – others are a bit more subtle and require some technical expertise, such as how to identify and overcome bias in training data.

I advocated to the audience for a use of a toolbox approach when dealing with AI today. It is important to get organised, educated and been conversant in AI terms. Luckily, this is not as hard as it used to be in the past. There is an incredible wealth of knowledge out there in the public and resources on AI are in abundance. You just need to have an organised way of getting around it; hence the toolbox metaphor. There are elements of AI technology which are good for certain domains and tasks and others are better at different tasks. Knowing what it works, where and how is key to successful AI implementations.

Blockchain and AI

I was invited to appear at a panel on blockchain and AI , at the Blockchain Week in London, January 2018.

With my fellow c0-panelist from FlyingCarpet, we debated on the uses and potential intersection of blockchain and Artificial Intelligence (AI). My long serving history in AI – involved with researching, developing, deploying and using AI systems since the 90s – and my enteprise explorations of blockchain in recent years; enabled me to identify the following areas of intersection and synergy between blockchain and AI:

AI and be used to improve operational efficiencies in blockchain(s):

- Blockchain’s

consensus mechanism are slow and expensive to run (e.g., the popular

proof-of-work (PoW) algorithm requires a lot of compute power, which translates

to consuming enormous amounts of electricity in order to validate transactions

and achieve consensus across all participants in a planetary scale network).

Although progress and explorations of different, less energy intensive

mechanisms have been explored, PoW remains the dominant choice. AI can

help with optimizing the path to consensus and calculate (semi-)

automatically the least compute-heavy, hence, less energy consumed, path to

consensus. - AI

can also help with smart agents – the birth place of multi-agent systems and topologies of agents

have been explored in AI since the 90s – tasked with orchestrating actions

between them to achieve federated consensus at the enterprise level. This could

cut the coordination time between nodes and more effectively managed network

resources to validate transactions. - AI use in

blockchain can have an impact on cost, as optimized blockchains would

result in more spare capacity, which then could be used for other

operations or re-directed to power up AI blockchains (GPUs from mining to DNN

training) - AI’s role in

blokchain smart contracts is big and sadly hasn’t been explored yet. AI and

smart go together. So AI does have a role in smart contracts. For

example, AI can enable more sophisticated triggering mechanisms for

smart contracts, which go beyond externally sources trigger points through

vetted oracles. There is little of no automation in monitoring and interacting

with a live smart contract; AI can help there with continuously learning best

execution paths and adjusting trigger points to suit the contextual changes in

the surrounding environment. - AI’s role in

redefining multi-modal interfaces is big. Lately, the advent and maturity of

virtual agents, like chatbots, is only a first demonstration of the different

modalities that could be the next user interface – go beyond keyboard and vocal

commands. Yet, developing and interacting with blockchain(s) and smart

contracts on-the-fly, is still done at the programming environment of software

development apparatus. An AI-driven multi-modal interface could help

lower the barrier of interaction with blockchain and empower new

innovations to emerge.

But, Blockchain(s) can also be used to improve AI:

- Explainable

AI: it’s a

commonly acknowledged issue with modern machine learning (ML) techniques that

they suffer from a black box syndrome – too many hidden layers in

mathematically elegant, but obscure to human eye networks, makes it difficult

to understand and visualize rationale for decisions made by AI systems. This

has a knock-on effect on trusting the AI system, regardless of the correctness

of the results. Blockchain(s) can help there as their core characteristic is

that of immutability and track and trace of verifiable audits. If we are in a

position to record all the high level steps followed by AI algorithms in an

immutable and traceable blockchain, we can then improve the explainability of

the system and be able to go back in time and explain any decision ever made by

that AI system. This could have an impact on the visibility of underlying

algorithms and reduce training data sets bias; - Data: most

state-of-the-art AI systems rely on gigantic data feeds, the scale of which

makes them affordable only by the very few tech conglomerates. But blockchain(s)

can help federate and demoncratize the data sourcing for AI systems.

More and better vetted data, federated and contributed by many, not selected

few, resuting in better models and results as a consequence and better AI

experience; - A bit far stretched

as an idea and mostly a thought experiment at the moment, but we could see the

emergence of “blockchain AIs”, that is, AI systems that they

themselves live on blockchain. Therefore, are by the nature of blockchaion,

immutable, shareable, decentralized – no central AI authority control. - Tokenized AI:

tapping a little into the inner mechanics of modern ML, blockchain

technology can help tokenize the rewards’ mechanism for emerging ML techniques,

like reinforcement learning. Typically, these are done at the programmatic

level, before the AI system is shipped out, but blockchain(s) can help tokenize

the entire reinforcement learning mechanism, thus providing new innovations and

economic incentives for a tryly distributed ML environment.

Blockchain and Energy

I was invited to appear at a panel on blockchain innovators in the energy sector, at the Blockchain in Energy Summit in London, November 2017.

With my fellow co-panelists Sweetbridge, Fifth9, rLoop, we elaborated on innovative uses of blockchain in the energy sector. It appears that blockchain can benefit a lot more industries than the traditional financial services use case. Energy, especially consumer energy consumption is a key area of focus for blockchain. I made the point at the panel that transactive energy is getting a lot of traction within the blockchain community and solid use cases emerge from both side of the Atlantic.

As I have had personally involved in large scale experiments with blockchain technology to make the utopia of decentralized, transactive energy trading powered by smart contracts, a reality, I backed my position with evidence of commercial interest in this space from some of the oil and energy supermajors I worked with. The future is bright for everyone with lots of (cheap) energy to keep us going and a green planet!we debated over a number of issues that shaped up blockchain in 2017.

One of the most intriguing use cases are where you can deploy smart contracts at the edge of a network to allow and empower prosumers (producers and consumbers of energy) to transact energy with fellow prosumers. This is no longer a nice idea, there are projects and early implementations of these systems at large energy companies and startups.

Blockchain State of Play

I was invited to appear at a panel on blockchain state of play in July 2o17, at the Blockchain Conference in Washington, DC.

With my fellow co-panelists from IBM, Consensys and EOS, we debated over a number of issues that shaped up blockchain in 2017. I was with Invesco at the time, representing the fund management industry’s view on blockchain. It appears that following a number of years with experimental proof-of-concept (PoC) applications, in 2017 we are likely to see the first production systems in the financial services that use some sort of blockchain technology.

Post-trading settlement and reconciliation services could be made more efficient and effective using blockchain to shrink the trades’ confirmation time to near real-time, when the business case to accommodate that is in place. We are also looking at blockchain technology to assist with internal operations, like for example proxy voting registry on an immutable, auditable and traceable blockchain backend.

I also pointed out to the unique characteristic of blockchain technology being a community-driven technology with the world’s largest consortia built around blockchain: Hyperledger, Ethereum Enterprise Alliance and R3 the most populous and well known in the financial services industry. A common practice among incumbents in this space is to collaborate and work out nuances and improvements in the technology together with peers rather than working in antagonistic silos.

In general, my statement at the panel and to DC audience was that blockchain technology is maturing, and maturing nicely. We shall not rush things and take time to evaluate properly the benefits and cost of using blockchain as this technology will be around for quite sometime, hence, the best strategy is to take a long term, strategic view and put blockchain to work on areas where it’s most applicable: speeding up confirmation of transactions among parties that have not transacted before, decentralize heavily concentrated processes at the core and build more distributed and fault tolerant systems; and evaluate the efficiencies of programmable, self-executed contracts, also known as smart contracts in blockchain jargon.